African AI Adoption Trends 2025

Africa is experiencing a remarkable transformation in artificial intelligence adoption, with investments reaching unprecedented levels and innovative applications emerging across key sectors. This comprehensive analysis examines AI development trends across 17 African countries, supported by an interactive dashboard and strategic recommendations for stakeholders driving digital transformation.

Continental Overview and Market Leaders

African countries demonstrate significant variation in AI readiness and adoption patterns, with clear leaders emerging across different metrics. South Africa leads the continent with an AI readiness score of 22 points, followed closely by Nigeria (19 points) and Kenya (18 points).

The continent's AI ecosystem encompasses over 2,400 startups with South Africa hosting 530 AI companies, Nigeria supporting 485 startups and Kenya maintaining 240 active ventures. Morocco has the highest ChatGPT usage rate in Africa at 38%, significantly exceeding the continental average and positioning the country second globally in AI tool adoption.

Kenya secured the largest single AI investment commitment in 2024, attracting $1.05 billion through the Microsoft-G42 partnership for comprehensive digital infrastructure development. This investment focuses on establishing green data centers powered by renewable geothermal energy and developing local-language AI capabilities.

Investment Growth and Financial Trends

African AI investments have experienced exponential growth, increasing from $1.2 billion in 2020 to a projected $4.1 billion in 2025, representing a 241% increase over the five-year period. The number of deals has similarly expanded from 45 transactions in 2020 to an estimated 203 deals in 2025, indicating broader ecosystem participation and maturation.

Microsoft has emerged as a major continental investor, committing $300 million to South Africa for cloud and AI infrastructure expansion through 2027. These investments build upon the company's existing $1.1 billion commitment that established Africa's first enterprise-grade data centers in Johannesburg and Cape Town.

However, African startups continue to receive less than 1% of global AI funding, with only $4 million raised across five deals in Q2 2024, compared to $23.2 billion raised globally during the same period. This funding disparity represents both a challenge and an opportunity for increased investment focus on the continent.

Sector Applications and Innovation Hubs

AI applications across Africa concentrate primarily in three sectors of agriculture, healthcare and fintech, which collectively attract the majority of investment and startup activity. Agriculture leads with 216 startups developing solutions for crop monitoring, disease detection, and precision farming, followed by fintech with 189 companies and healthcare with 114 ventures.

Successful agricultural AI implementations include PlantVillage Nuru in Kenya, which helps farmers diagnose crop diseases using smartphone technology and local language processing. In Ghana, AI-powered soil testing kits provide personalized fertilizer recommendations, while Rwanda's Mkulima GPT offers agricultural advice in Swahili through ChatGPT integration.

Healthcare AI applications span from Nigeria's Ubenwa startup, which uses machine learning for birth asphyxia diagnosis, to South Africa's diabetic retinopathy detection systems and Tanzania's computer-aided tuberculosis diagnosis from chest radiographs. These innovations demonstrate AI's potential to address critical healthcare challenges in resource-constrained environments.

Major tech hubs have emerged across the continent, with Lagos ranking as the world's fastest-growing tech ecosystem according to the 2025 Global Tech Ecosystem Index. Johannesburg and Kampala also secured positions among the top 20 fastest-growing tech cities globally, reflecting Africa's accelerating digital transformation momentum.

Infrastructure Challenges and Digital Divide

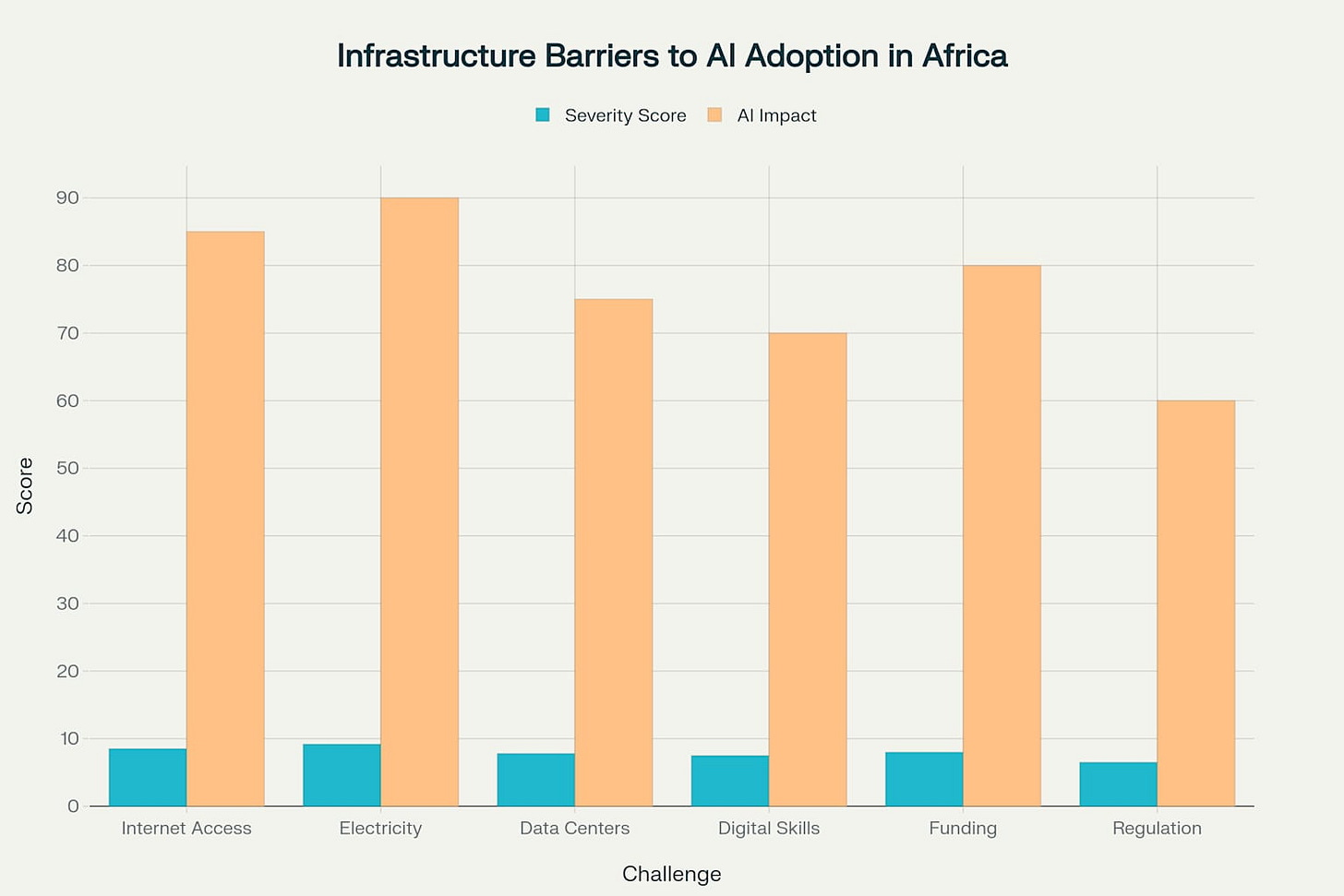

Despite significant progress, Africa faces substantial infrastructure barriers that limit AI adoption and deployment. Electricity access remains the most critical challenge, with a severity score of 9.2 out of 10, affecting 45 countries and creating a 90% impact on AI adoption potential

Internet connectivity presents another major barrier, with only 27% mobile internet penetration in Sub-Saharan Africa despite 83% mobile broadband coverage. This represents a substantial usage gap of 60%, where people have network access but cannot afford or effectively utilize internet services. The digital divide particularly affects rural communities, where only 15% have internet access compared to 50% in urban areas.

Data center capacity remains severely limited, with Africa accounting for less than 1% of global data center infrastructure. Current estimates suggest the continent needs at least 700 data centers by 2030 to meet digital demand, requiring massive infrastructure investment and strategic partnerships.

Continental Strategy and Policy Framework

The African Union Continental AI Strategy adopted in July 2024 provides a comprehensive framework for coordinated AI development across the continent. This strategy emphasizes five focus areas which are harnessing AI benefits, building capabilities, minimizing risks, stimulating investment and fostering cooperation.

Seven African countries have developed national AI policies with Rwanda's National AI Policy successfully passing into legislation in 2023. Ghana, Tunisia, Morocco and Egypt have also established comprehensive AI strategies while Nigeria, Kenya, and Ethiopia maintain draft frameworks under development.

UNESCO provided technical and financial support for the Continental AI Strategy development, demonstrating successful international collaboration in AI governance 2023. The strategy builds upon existing continental frameworks including the AU Data Policy Framework and the Digital Transformation Strategy.

Strategic Recommendations and Implementation Roadmap

Based on comprehensive analysis of continental trends and successful implementation models, strategic recommendations target four key stakeholder groups which are government policymakers, private investors, tech entrepreneurs and international development organizations.

Read the full Africa AI Recommendation here ...

Government policymakers should prioritize implementing national AI strategies following the AU Continental AI Strategy framework, with critical timelines of 12-18 months for policy development. Infrastructure investment represents the most critical priority, requiring massive expansion of broadband coverage, reliable electricity supply and local data center capacity over 5-10 year timelines.

Private investors should focus on agriculture and healthcare AI applications which demonstrate 30-45% annual growth potential and significant social impact. Early-stage startup support presents substantial opportunities, given that 63% of African AI startups remain in early development phases. Infrastructure development investments, particularly green data centers and satellite connectivity solutions, show strong fundamentals for long-term returns.

Tech entrepreneurs should prioritize Africa-centric solutions that address local challenges through mobile-first approaches, leveraging the continent's 70%+ mobile penetration in leading countries. Strategic partnerships with academic institutions, following models like Imperial College's Ghana hub and Makerere University's AI center, provide essential research collaboration and talent development.

International development organizations should support continental coordination through funding AI strategy implementation, addressing digital divide challenges and building research capacity across multiple countries. Priority programs include affordable device financing, digital literacy training and women and youth inclusion initiatives.

Interactive Dashboard and Analysis Tools

A comprehensive interactive dashboard has been developed to support stakeholder decision making and trend analysis across African AI adoption metrics. The dashboard provides real-time exploration of country-specific data, investment patterns, sector applications and infrastructure challenges through dynamic visualizations and filtering capabilities.

The dashboard features country performance comparisons, investment trend analysis, sector-specific insights and infrastructure challenge assessments. Users can explore detailed metrics for each of the 17 analyzed countries, including AI readiness scores, ChatGPT usage rates, startup ecosystem size and investment commitments. Interactive charts enable stakeholders to identify patterns, compare performance across countries and access strategic recommendations tailored to their specific roles and interests.

All dashboard recommendations include hyperlinked sources to relevant research, policy documents and implementation guides, ensuring users can access detailed supporting information for strategic planning and decision making processes.

Economic Impact and Future Projections

McKinsey analysis projects that generative AI could deliver up to $103 billion in annual economic value for Africa across retail, telecommunications and banking sectors. Conservative estimates suggest AI could contribute $1.2-1.5 trillion to Africa's GDP by 2030, representing a 50% increase in current continental GDP equivalent.

Countries with national AI strategies demonstrate 40% faster startup growth compared to those without comprehensive frameworks. Agricultural AI adoption improves crop yields by 15-25%, while healthcare AI implementations reduce diagnostic time by 60% in pilot programs. These leading indicators suggest substantial economic returns for countries that invest strategically in AI development and deployment.

The next 24 months represent a critical window for Africa's position in the global AI landscape, requiring coordinated continental approaches, massive infrastructure investment, strategic public-private partnerships and inclusive development focus. Success in this timeframe will determine whether Africa can leverage AI for leapfrog development or risk being left behind in the global digital transformation.